House And Property Deeds: A Buyers Guide

Table Of Content

- How Much To Offer On A House + Reasonable Offer Chart

- Buying A Lake House: What You Need To Know And Consider

- Why Is A House Deed Important To Property Ownership?

- Learn About Quicken Loans

- View Real Estate Records by Appointment

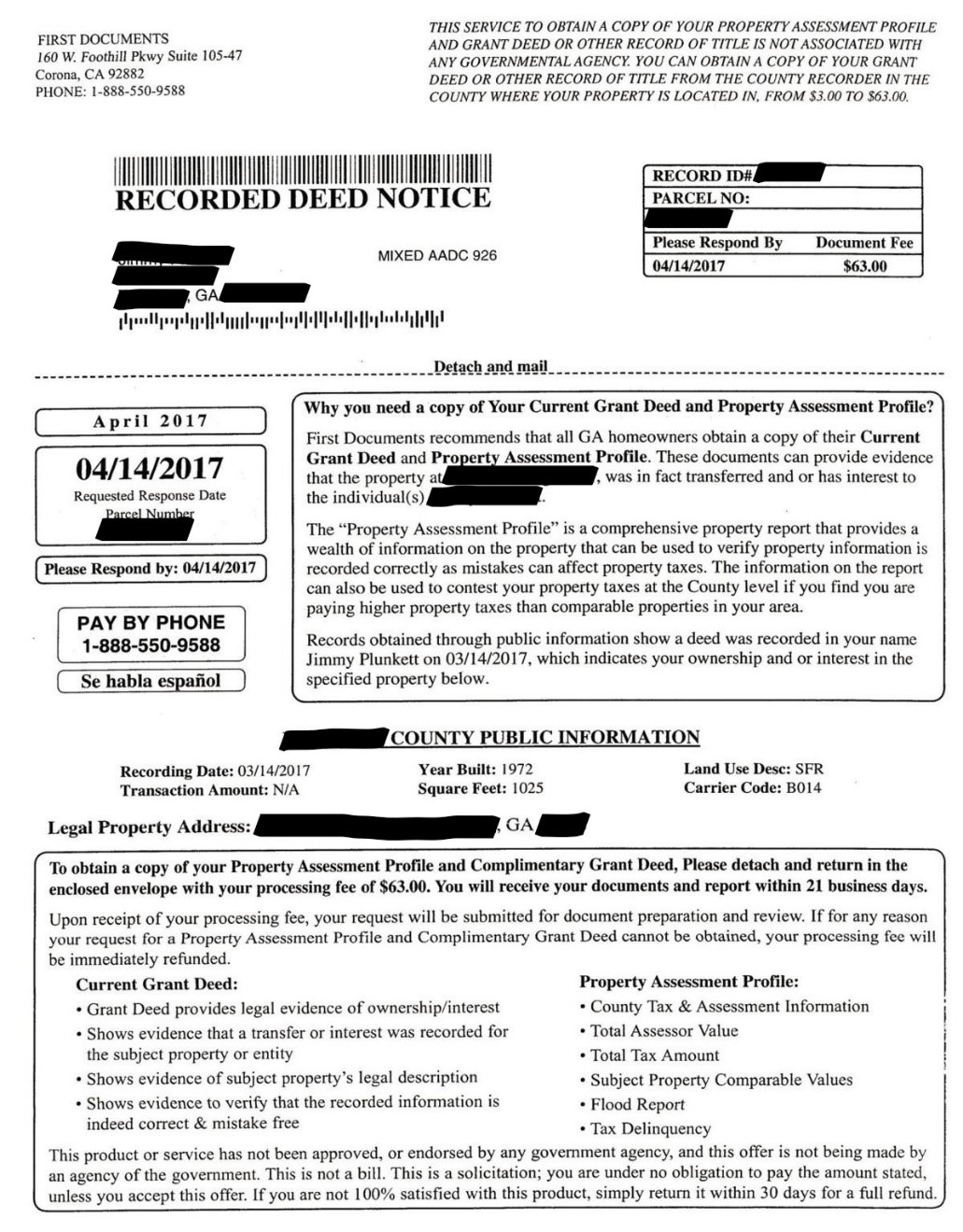

- Title fraud thieves could steal your home while you're still living in it. How to protect yourself

Real estate records for Los Angeles County since 1850 are available after they have been filed with the Property Document Recording section. These records are available for purchase in person, online or by mail. Within a deed of trust contract, the lender can initiate a simplified foreclosure process without a prolonged court proceeding.

How Much To Offer On A House + Reasonable Offer Chart

These deeds are filed with the local government and are kept as public record. There are many types of property deeds, each with its own unique use – from warranty deeds used to transfer residences in sales to deeds used to transfer inheritance. They are recorded at the local county recorder’s office and can usually be accessed by anyone interested in viewing the property’s history and ownership details. From time to time, people confuse the terms “house deed” and “house title” because they both pertain to property ownership rights.

How do we add our sons’ names to our home’s deed? - NJ.com

How do we add our sons’ names to our home’s deed?.

Posted: Fri, 21 Feb 2020 08:00:00 GMT [source]

Buying A Lake House: What You Need To Know And Consider

There are also instances when you need to change your deed because you found a typo or clerical error, or you need to refinance your home. A deed is not valid unless it includes a legal description of the property. This is not as simple as writing down the property’s mailing address. A legal description includes several pieces of identifying information, such as the lot numbers, physical boundaries, and easements. One way to think about the differences between a deed and a title is to look directly at the words themselves.

Why Is A House Deed Important To Property Ownership?

The transfer of property from a deceased relative depends on their will and trust. If they didn’t leave a will, an administrator’s deed could be used depending on local laws. Next, enter the identifying information of the parties involved in the transaction. Be careful to use the full name of each party and utilize the correct spelling. As mentioned, a general warranty deed imparts a full warranty of title.

Securing your property deed isn’t just a logistical step; it’s an emotional milestone. Knowing that the property is unequivocally yours offers a profound sense of security. Whether it’s watching your children grow up in their rooms or planting a garden in the backyard, the certainty that this space is yours amplifies every joy and memory. Once you have the deed to your house, safeguarding it becomes paramount.

If available, your county may provide an official records search site where you can input your property’s information, find the deed, and download a copy onto your computer. Be prepared to provide the owner’s name, property street address, and parcel number if available. You can enlist the services of an abstractor or local title company to visit the recorder’s office on your behalf. The turnaround times and cost of this service will vary depending on the company. With all the different types of legal documents in real estate, it can be a bit confusing to keep up, especially for new homeowners.

Join 100,000+ business leaders

A special warranty deed provides the grantee with a limited warranty of title. Essentially, the warranty is limited because it only covers the timespan that the grantor owned the property. With a special warranty deed, the grantee assumes some risk in that they would be responsible for any encumbrances that occurred before the grantor took ownership. The grantee is also unable to sue the grantor for not transferring a clear title.

House deeds are often called property deeds and are a crucial part of the closing process in any real estate transaction. Because deeds are public documents, it is best to present the changes you want to make at your local county recorder’s office. Some options include using a correction deed or recording a new deed. The type of action used is best advised by your county or a real estate attorney for more complex circumstances. House deeds are important because they show who has legal ownership interest in a property. If you’ve been through the home buying process, you’re probably already at least somewhat familiar with house deeds.

One single owner who owns their house outright will sell their home to another single purchaser. However, there are instances when deeds can get complicated and tricky. There are cases in which the deed could be incorrect, or cases involving multiple owners who have equal claim to a property. Outside parties could also make a claim against the property, such as in the case of foreclosures or tax issues. First of all, if a child is added as a co-owner, there are gift tax considerations. There is a limit to how much someone can gift another person without paying a gift tax, both yearly and in a lifetime.

With tenancy by entirety, a married couple is viewed as a single legal entity for the purposes of property ownership. Below are some of the most common ways a homeowner can hold title and how they typically work. However, the types of ownership available to you and the specifics of those types can vary depending on your state’s laws. When you buy a house, the seller (also known as the grantor) will sign this document, deeding the house to you (the grantee). The deed will then be filed with the appropriate government office for your county, such as the clerk or the register of deeds. More commonly, a homeowner will, knowingly or not, try to sell a home that has some type of lien on it.

Starting with a simple estate plan or the purchase of a personal residence, and moving all the way to complex estate plans and real estate transactions. I regularly advise small business owners and real estate investors. The special warranty property deed offers relatively lesser protection to grantees.

Meanwhile, the seller maintains ownership of the property until the full purchase amount is settled. The county clerk's office can provide information about any local rules and requirements. If you have any questions or need legal assistance, please talk to an attorney. Inheriting a property comes with a step-up in basis (which means it's reassessed at current market value) potentially eliminating capital gains tax. This type of ownership means that your property is held in a trust by you, for you; you’re both the trustee and the beneficiary. With tenancy in common, each owner has a right to sell, give away or otherwise do as they wish with their ownership interest.

It includes essential information such as the names of the current and new owners, a legal description of the property, and the signature of the person transferring the property. A property deed is a legal document that signifies the transfer of ownership from the seller (often termed the grantor) to the buyer (termed the grantee). It contains a detailed legal description of the property, the names of the parties involved, and usually requires a signature from the grantor. Think of it as the official baton in a relay race, which, when passed, changes the hands of property ownership. When it comes to real estate education, there is plenty of information regarding the importance of the house deed, property titles, and having legal proof of ownership to your house.

Deeds are officially recorded at the local county office in which the property is located. More specifically, it is usually filed at the county register office. Note that the specific office name can differ by state and municipality.

Comments

Post a Comment